Efficiency in Payroll Management: From Processing to Accounting with ZOHO Payroll

Is your company still relying on spreadsheets to manage payroll and complete laborious manual tasks? Are you collecting documents via email and switching between multiple applications to achieve the desired outcome?

Is your company’s payroll staff faced with the daily challenge of managing data in fragments and spending time responding to employee inquiries due to a lack of centralization? Is it an arduous task for them to achieve a streamlined process?

Challenges in managing employee records

- Outlining employee policies: Before starting with payroll, company first need to define employee policies which include salary structure, PF, Gratuity, allowance, leave policy, incentives and salary during notice period in compliance with laws and tax regulations.

- Disperse Data: Basic information of employees like personal information, CTC, pay slips, tax deductions, bank account details etc. are scattered in spread sheet.

- Employee self-service: Providing employees with easy access to their personal information in one convenient location.

- Accurate and timely processing: Payroll departments must ensure that employee paychecks are processed accurately and on time. This can be challenging, particularly when dealing with large numbers of employees or complex pay structures.

- Data security: Payroll departments handle sensitive employee information, such as Social Security numbers and bank account information. Ensuring that this information is kept secure is a major challenge.

How ZOHO Payroll solve these Challenges?

Zoho Payroll is cloud-based payroll management software that helps companies automate their payroll process. It can handle tasks such as calculating paychecks, withholding taxes, and generating reports. It also allows companies to manage employee information, benefits, and time-off requests. Additionally, it integrates with Zoho Books and Zoho CRM, allowing for streamlined financial and HR management. It also allows the compliance to be handled easily. With the software, companies can save time and reduce the risk of errors, allowing them to focus on growing their business.

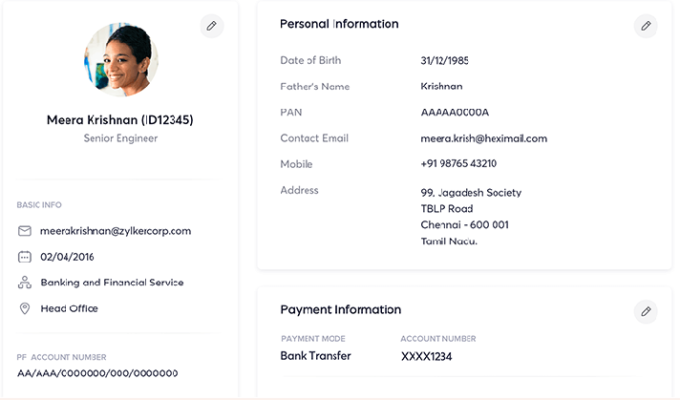

1. Centralized data: Information about employees is centralized at one place. Even in the absence of the employee who handles payroll for the company, salary and payments can be easily managed by any other employee because data is not scattered and is segregated at one place. All the employee details are centralized

- Employee Details: Zoho Payroll’s Overview tab contains personal and bank details, Salary tab calculates salary with CTC, allowances, and deductions, Investment tab records employee investments and calculates TDS, Pay-slips and Forms tab manages pay-slips and Form 16, Payment Info tab allows selection of payment options like direct pay, cheque, or bank transfer.

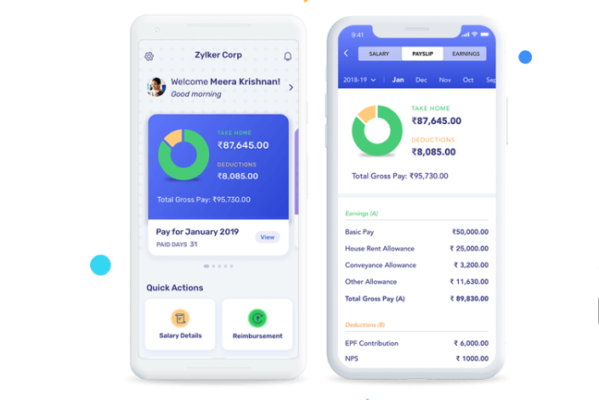

- Client Portal: Even employees are provided with dedicated client portal where they can do many things like get form 16, salary structure, taxes and deductions, pay slips, upload tax saving documents etc. , on their own rather than doing errands to Payroll department.

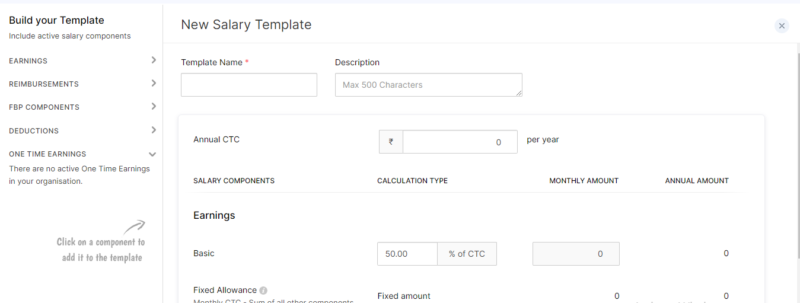

2. Customization: Zoho Payroll allows for a high degree of customization to accommodate the unique needs of a business. Here are a few examples of ways that the software can be customized:

- Payroll rules: The software allows you to set up custom payroll rules to automatically calculate deductions, taxes, and other payroll-related tasks.

- Salary structure: The software allows you to create a custom salary structure for each employee, including the option to add different types of allowances and deductions.

- Customized Template: The software allows you to customize different pay-slip templates depending on company’s requirement.

- Tax Setup: The software allows you to set up tax related customizations such as adding exemptions and tax slab as per the country laws.

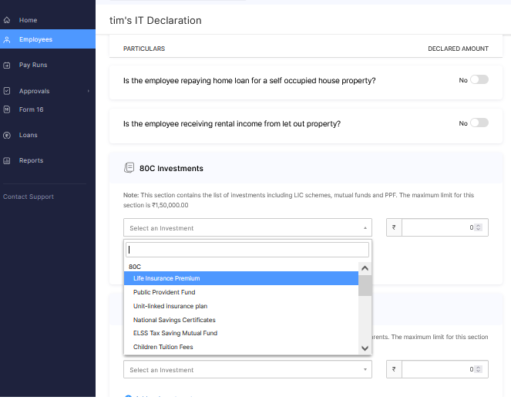

3. Tax Liability Calculation: Zoho Payroll calculates an employee’s tax liability by using information entered into the system, such as their income, deductions, and exemptions. It uses the current tax laws and rates set by the government to determine how much tax should be withheld from an employee’s paycheck.

The software takes into account the employee’s income, exemptions, and deductions to calculate the employee’s taxable income. It then uses the tax rates set by the government to determine how much tax should be withheld from the employee’s paycheck. The system will also handle with different tax slab and exemptions available.

It also calculates any additional taxes that may be applicable, such as state and local taxes, and ensures compliance with all relevant laws and regulations. The system will provide the option to generate form 16 for employee which shows the tax liability for the year.

4. Integration: Integrating Zoho Payroll with other Zoho applications provides a seamless, end-to-end solution for managing and tracking your payroll needs.

- Integration with Zoho Books: Zoho Payroll seamlessly integrates with Zoho Books, allowing users to manage their payroll and accounting in one place. This integration also allows users to create invoices and transfer payments to employees’ bank accounts directly from Zoho Books.

- Integration with Zoho people: Zoho Payroll’s integration with Zoho People application allows for streamlined and automated HR processes, making it easier for businesses to manage their payroll operations. It is also in partnership with various banks to flow salary directly into employee’s bank account.

5. Data Backup and Safety: ZOHO Payroll takes data security seriously and has implemented several measures to protect employee information. ZOHO Payroll uses role-based access controls to restrict access to employee information to authorized personnel only. Also it has a Data backup and recovery process, in case of any data loss.

- Encryption: ZOHO Payroll uses encryption to protect sensitive employee information, such as Social Security numbers and bank account information, both in transit and at rest.

- Access controls: ZOHO Payroll uses role-based access controls to restrict access to employee information to authorized personnel only.

- Multi-factor authentication: ZOHO Payroll supports multi-factor authentication to further secure employee information.

- Regular security audits: ZOHO Payroll conducts regular security audits to ensure that employee information is being protected.

- Compliance with industry standards: ZOHO Payroll is compliant with industry standards such as SOC 2, SOC 3, ISO 27001, and PCI DSS.

6. Mobile Zoho Payroll App: Zoho Payroll has a mobile app that allows users to manage payroll on the go through self-service portal. The app is available for both iOS and android devices and it allows almost all the features that web application provides. The app allows businesses to manage payroll on the go, making the process more efficient and convenient.

For businesses, payroll expenses can be substantial. Investing in Zoho Payroll is an investment well worth making for any small business. Zoho Payroll provides a comprehensive suite of payroll tools that allow small businesses to manage their payroll efficiently and conveniently. This platform can help streamline payroll processes and automate payments.

By leveraging our experienced professionals to provide guidance and insight into the best practices, you can manage business processes with more ease and maximize the efficiency.